How Do You Calculate Reduced Hours Salary

Since straight-time earnings have already been calculated see Step 1 the additional amount to be calculated is one-half the regular rate of pay 10 x 5 5. Thats as true for part-time work as for salary work.

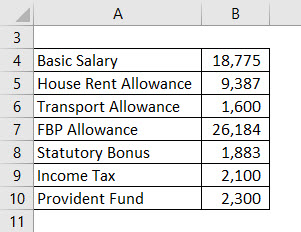

Salary Formula Calculate Salary Calculator Excel Template

If you are working out the new salary by number of hours worked enter the pro-rata number of weekly hours into the Pro-rata weekly hours box.

How do you calculate reduced hours salary. 59000 - 56000 3000 5900056000 3000 Divide the amount of the reduction by the original amount to find the rate of reduction. Next take your weekly wages and multiply it by 52 weeks. Calculate total compensation for week.

Calculate how much less youll pay on child-care and add that to the mix. Work out any change to CTC or WTC if applicable using this benefits checker 3. 10 regular rate of pay x 5 x 10 overtime hours 50.

How much do you get paid. Hourly daily weekly monthly annually. Subtract the final amount from the initial amount to find the amount of the reduction.

This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate. My salary is currently 20050 annually before any reductions. Multiply by the number of furlough days in the pay period or partial pay period youre claiming for.

Divide the employees salary by 52 weeks in the year Divide the employees weekly salary by the number of days they normally work OR number of hours they normally work Multiply the employees hourly or daily rate by the number of hours or days missed Subtract the number from Step 3 from the employees usual pay period amount. Part-time salaries are typically based on full-time salaries divided by the number of hours worked. Divide by the total number of days in the pay period youre calculating for.

I have a employer contribtion pension and I pay 7 of my monthly salary to that. Divide her salary for the pay period by the number of hours salary is based on. Heres how it looks once we put these numbers into the equation.

Find out the benefit of that overtime. Number of hours per week x hourly rate x number of weeks in a year annual salary Again there are 52 weeks in each year and for this example lets say you work 35 hours per week and earn 1099 per hour. Some companies pay part-time employees a discounted rate that is less than the equivalent full-time salary.

500 straight-time pay 50 overtime pay 550. For example 50000 divided by 24 pay periods comes to 208333 which is her semi-monthly salary. For example if your salary was 59000 and it was reduced to 56000 youd have.

Also benefits are typically lower for part-time employees. Use the pro rata calculator above to find out how it translates into take home pay. Do it in a few steps 1.

Multiply this amount by 075. Determine the employees average annual salary or hourly wage during the most recent full quarter before the Covered Period. I work 365 hours per week.

To determine whether the fee payment meets the minimum salary level requirement the test is to consider the time worked on the job and determine whether the payment is at a rate that would amount to at least 684 per week if the employee worked 40 hours. Enter the hourly rate in the Hourly Wage box and the number of hours worked each week. Calculating your hourly wage into an annual salary is simple.

My tax code is 747L so based on this info can someone tell me what my money situ wouyld be if hours reduced to 295 hours thanks in advanced for any help you can give. To calculate whether a salaryhourly wage reduction is required you will calculate the average salary or hourly wage rate reduction for each FTE employed during the covered period who either was hired in 2020 OR received 100000 or less on an annualized basis during any pay period in 2019 as compared to a defined look-back period first. To calculate salaryhourly waged reductions for remaining employees who did experience a salaryhourly wage reduction over 25 and do not meet the safe harbor follow these steps.

Run your new gross pay through something like this income tax calculator to get your new take-home 2. For example you may be paid an annual salary of 25000 pro rata - but you only actually work for part time in which case youll be paid a proportion of the 25000 based on how much of the expected time youre actually working. This is your weekly wages.

Multiply your hourly wage by 40 hours. If you want to see a percentage of your current salary enter that percentage into the of full-time salary box. There is in depth information on how to estimate salary earnings per each period below the form.

What Is Annual Income How To Calculate Your Salary Salary Calculator Income Income Tax Return

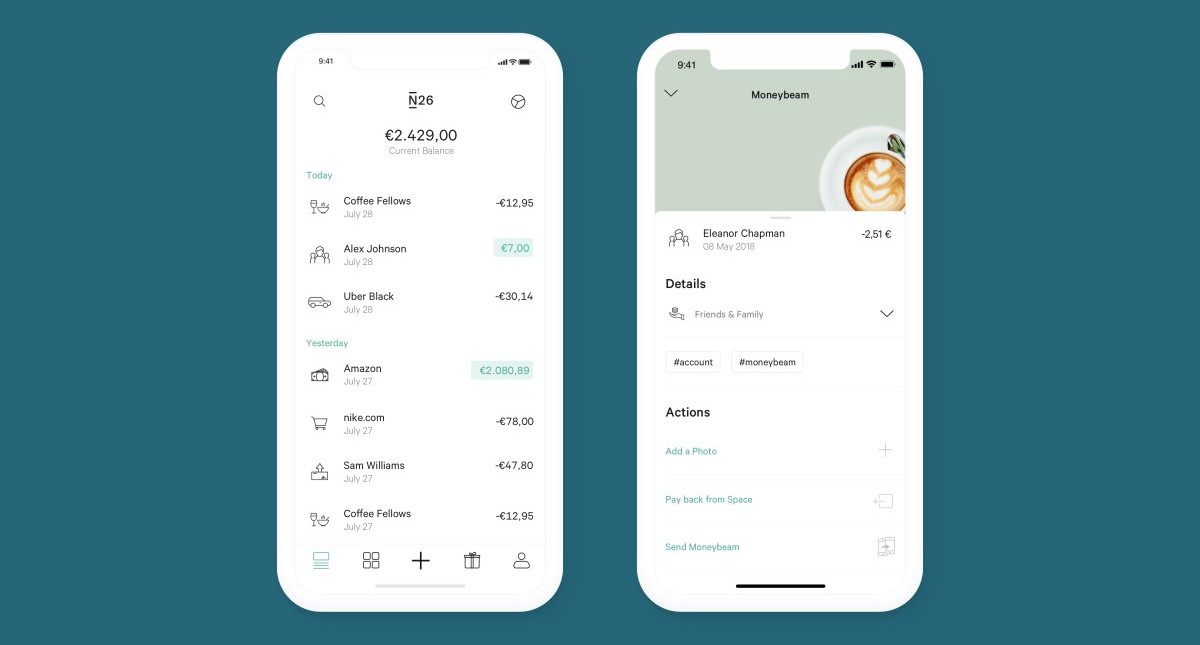

Base Salary Explained A Guide To Understand Your Pay Packet N26

How To Start A Budget 6 Easy Steps Swift Salary Budgeting Debt Reduction Personal Finance Budget

With Happycuit Imagine Happiness Imagine The Increase In Financial Assets Imagine That The Sales Of The Business Grew Grow Business Salary Increase Percents

Base Salary Explained A Guide To Understand Your Pay Packet N26

Calculating A College Degree S True Value College Degree Online College Degrees Online College

Salary Calculator 2021 For Employees Ms Excel Salary Calculator All Pak Notifications In 2021 Salary Calculator Salary Salary Increase

Welcome You Are Invited To Join A Webinar Csc Employment Rights Chinese After Registering You Will Receive A Confirmation Email About Joining Webinar Small Business Development Business Development

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Calculator Templates

How Do I Calculate Income Tax On Salary With Example Life Insurance Calculator Life Insurance Premium Premium Calculator

Salary Formula Calculate Salary Calculator Excel Template

Should You Accept Stock Options In Exchange For A Lower Salary

Salary Formula Calculate Salary Calculator Excel Template

What Is A Salary Band And How Can You Create One

Car Depreciation Calculator Calculator Finance Car

Base Salary Explained A Guide To Understand Your Pay Packet N26

Salary Formula Calculate Salary Calculator Excel Template

Web 3 0 Natural Language Processing Flexible Working Salary Calculator

Post a Comment for "How Do You Calculate Reduced Hours Salary"